About Us

Access to commercial finance and investment remains the biggest barrier to the growth and development of women-owned firms especially for the micro family-based businesses in the Pacific. Most female businesses lack proper structure and documentation of their business processes. This includes the absence of know-your-customer (KYC) documents and proof of previous transactions and savings. Thus, making it riskier and unattractive for commercial banks and venture capitalists to invest in women-owned businesses.

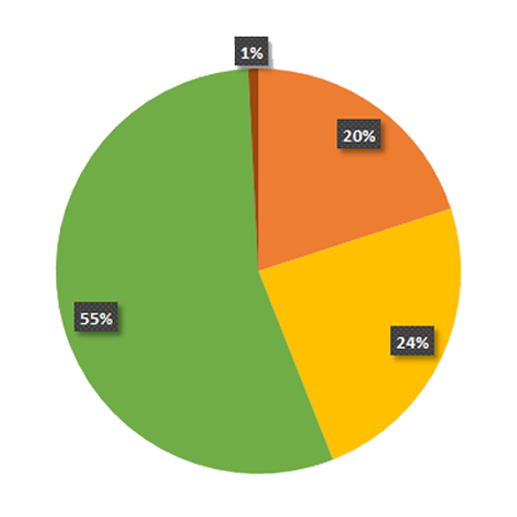

The effects of lack of access to finance on women entrepreneurs are evident in their inability to enter a business or scaleup their existing business or compete with other businesses in the domestic and international markets. It prevents them from accessing development and government funds and limits their ability to engage in public procurement. According to ITC, only 1 percent of women owned businesses get government contracts. Finally, it affects their ability to access and leverage the potentials in digital technology to scale their businesses.

This platform will serve as a source for all information relating to access to Finance, and also serve as a platform for engagement among women owned businesses in the Pacific